The Landscape for Impact Investing in East Africa

This report from the Global Impact Investments Network (GIIN) presents a detailed analysis of impact investing activity in East Africa, examining the supply of global impact investment capital as well as the demand for investment resources from small and medium enterprises (SMEs), social enterprises, and others who aim to drive social and environmental impact through the private sector.

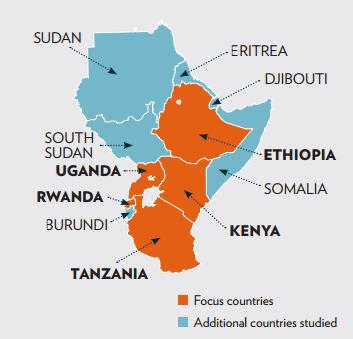

The report covers five “focus countries” in depth: Kenya, Uganda, Tanzania, Ethiopia, and Rwanda; and six additional countries in the region in less depth: Burundi, Sudan, South Sudan, Djibouti, Eritrea, and Somalia.

The report covers five “focus countries” in depth: Kenya, Uganda, Tanzania, Ethiopia, and Rwanda; and six additional countries in the region in less depth: Burundi, Sudan, South Sudan, Djibouti, Eritrea, and Somalia.

For the purpose of this report, impact investors are defined as those who invest with the intention to generate a beneficial social or environmental impact alongside a financial return—and who seek to measure the social or environmental returns generated by their investments.

East Africa is one of the centers of global impact investing, as activity has grown strongly throughout the region over the past five years. More than USD 9.3 billion has been disbursed in the region through by more than 1,000 direct deals by development finance institutions (DFIs) and other impact investors active in East Africa today (Figure 1).1 In total, 155 impact investors currently manage 203 active investment vehicles in the region, and many more are considering the region for future commitments.2 Kenya and its capital city Nairobi are the regional hub of East African impact investing. At least 48 impact fund managers have staff placed in Nairobi, which is more than three times as many local offices as in any other country in the region. Almost half of the USD 9.3 billion in impact capital disbursed in East Africa has been in Kenya—more than triple the amount deployed in each of Uganda and Tanzania, the countries with the next highest amounts at around 13% and 12% respectively. Despite having the largest economy in the region (in PPP terms), Ethiopia has received only around 7% of disbursements to date. Rwanda, with an economy just one-eighth the size of Ethiopia’s, has received half as much impact capital, or 4% of all disbursements in the region.

Download the summary per country:

Report on Impact investment opportunities in Rwanda by Global Impact Investments Network (pdf)

Report on Impact Investment opportunities in Ethiopia by Global Impact Investments Network (pdf)